ASK YOUR STATE REP to co-sponsor Amendment #1357 to H.3800 (House Budget)

For more updates like this, sign up for our mailing list at

TL; DR:

-

Massachusetts has seen one of the largest tax decreases of any state over the past 40 years

-

High-income households pay a smaller share of their income in taxes every year than low-income households

-

MA systematically underfunds public education, public transportation & infrastructure programs

-

We can act now to raise $1 billion per year by passing Amendment #1357 to the House Budget (H.3800), filed by Rep. Mike Connolly.

-

Amendment #1357 would raise the capital gains tax. Capital gains are profits earned by things like selling stocks or bonds (401ks aren't included)

-

80% of all capital gains are earned by the top 1% of income earners.

-

Only 3% of capital gains go to the bottom 80% of income earners. Even so, the amendment includes exemptions for low-income earners to ensure they aren't burdened by the tax.

ASK YOUR STATE REP to co-sponsor Amendment #1357 to H.3800 (House Budget)

The Problem: A Broken Tax System

Everyone has heard the joke about "Taxachusetts" but the reality is far more complicated.

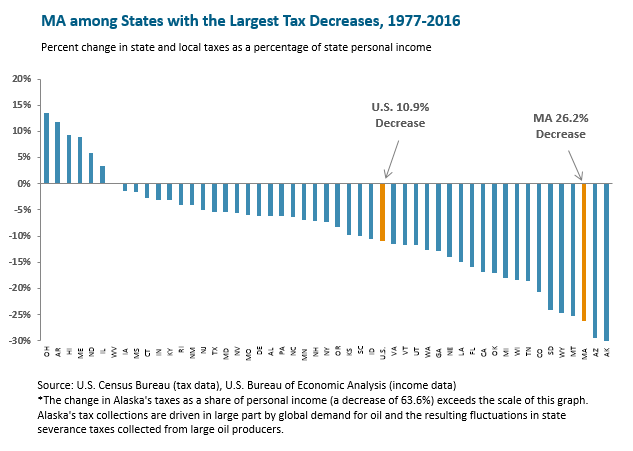

1. Massachusetts has seen the third largest decrease in taxes of any state over the last 40 years.

From [MassBudget Report](http://www.massbudget.org/report_window.php?loc=How-Has-the-Level-of-Taxes-in-Massachusetts-Changed-Compared-to-Other-States.html)

From [MassBudget Report](http://www.massbudget.org/report_window.php?loc=How-Has-the-Level-of-Taxes-in-Massachusetts-Changed-Compared-to-Other-States.html)

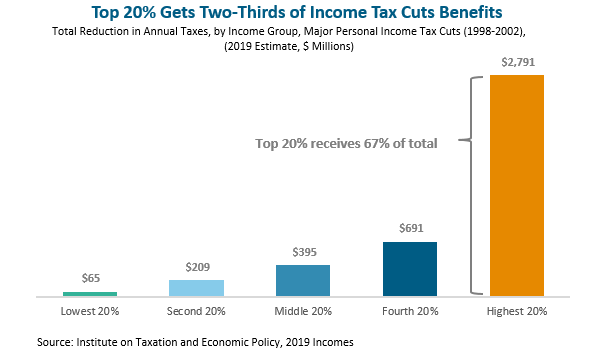

2. These tax decreases have gone disproportionately to the richest in our society.

The Top 20% of income earners have taken 67% of all the tax gains, and the poorest 20% have gotten almost no tax relief

From [MassBudget Report](http://www.massbudget.org/report_window.php?loc=Income-Tax-Cuts-Cost-Massachusetts-Over-$4-Billion-Annually.html)

From [MassBudget Report](http://www.massbudget.org/report_window.php?loc=Income-Tax-Cuts-Cost-Massachusetts-Over-$4-Billion-Annually.html)

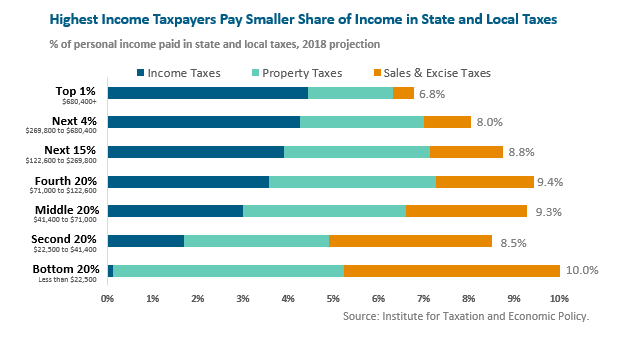

3. The wealthiest 1% in MA are paying a dramatically lower share of their income in taxes

MassBudget puts the situation in stark terms:

Large tax cuts enacted in Massachusetts during the last several decades – affecting both state and local tax collections - have significantly reduced our ability to invest in our communities. At the same time, our state and local tax system remains “upside-down”: low- and moderate-income households pay a larger share of their income in taxes than do households with higher incomes. In fact, the highest-income households in Massachusetts – those in the top 1 percent – pay a smaller share of their income in state and local taxes than does any other income group.

Moreover, the upside-down structure of our tax system is particularly detrimental to Black and Latinx communities. Due to a long history of systemic barriers to opportunity, Black and Latinx households are over-represented in lower-income groups (the groups paying more of their income in taxes) and under-represented in high-income groups (the groups paying a smaller share of their income in taxes).

Source: MassBudget Report: 14 Options for Raising Progressive Revenue

From [MassBudget Report](http://massbudget.org/report_window.php?loc=Who-Pays-Low-and-Middle-Earners-in-Massachusetts-Pay-Larger-Share-of-their-Incomes-in-Taxes.html)

From [MassBudget Report](http://massbudget.org/report_window.php?loc=Who-Pays-Low-and-Middle-Earners-in-Massachusetts-Pay-Larger-Share-of-their-Incomes-in-Taxes.html)

4. We are underfunding critical programs like education

-

A MassBudget report last year found that Massachusetts was underfunding public education by over $2.6 Billion dollars a year.

-

This funding shortfall falls especially hard on poor communities, which tend to skew less white than wealthier suburbs that have local resources to make up the funding gaps.

-

This creates a situation in which the wealthiest in Massachusetts pay less in taxes and their children have better schools.

And it's not just education. Roads, bridges, public transportation, assistance programs for low income learners, and health care subsidies are all receiving far too little funding and we're falling short as a state.

Previous Reform Efforts Failed

Over the past few years, activists from Raise Up Massachusetts, a coalition of progressive, labor and faith groups gathered hundreds of thousands of signatures to get the Fair Share Amendment on the ballot.

This "Millionaire's Tax" would have raised income taxes by 4% on incomes over $1 million per year. Only 14,000 households in MA have such an income, so the tax would have only affected those in the top 1%.

However, the Supreme Judicial Court of Massachusetts (5 of 7 judges appointed by Republican Governors) removed the measure from the 2018 ballot on a technicality.

The tax had been predicted to bring in $2 billion of tax revenue a year, but Republican-appointed judges killed that possibility.

There are efforts underway to have the legislature make this same change to our tax rate, but the MA constitution requires any such change to be voted on by two legislative sessions in a row, effectively meaning there's no possibility to get the Fair Share tax to come into effect before 2023, 4 years from now!

Meanwhile, previous tax cuts for the wealthy and stagnant wages have lead to a situation that one State Rep calls "two-decades-long program of austerity."

But we can act now on April 22nd

Sixteen progressive State Reps from around the state know we can't wait, and have acted to introduce a budget amendment that will be voted on April 22nd.

Unlike the Fair Share, this isn't a constitutional amendment, so it can be passed into law immediately and begin raising revenue that's desperately needed around the state.

This Budget Amendment #1357, will raise taxes on Long Term Capital gains from 5.05% to 8.95%. This is estimated to raise over $1 Billion a year in new revenue.

And it's extremely progressive:

- Over 80% of all Capital Gains accrue to the top 1% of income earners

- Over 97% of all Capital Gains accrue to the top 20% of income earners.

- The bottom 80% of earners only receive 3% of the total capital gains.

- And Rep. Connolly's amendment introduces a special exemption for low income earners to ensure low income people aren't hurt by the change.

What you can do

-

Ask your State Rep to co-sponsor Amendment #1357 to H.3800 (House Budget) as soon as possible. (You can look up your state rep at www.WhereDoIVoteMA.com if you aren't sure who it is)

-

Ask your State Rep to stand for a roll call vote on April 22nd. As we covered in our 2nd video, State House Leadership can kill amendments without a vote unless sixteen Reps physically stand to ask for a recorded vote.

-

Join a phonebank with Act on Mass over the next week. We'll be calling voters across the state to ask them to call their Reps and sign on. Find events on our Facebook Page: https://www.facebook.com/pg/act.on.massachusetts/events

The sixteen Reps who "co-sponsored" as of Friday 4/12 at 5PM are:

(If your Rep is on this list, call them to thank them for co-sponsoring but ask them to stand for roll call vote on 4/22)

- Mike Connolly of Cambridge

- Nika Elugardo of Boston

- Tami Gouveia of Acton

- Maria Robinson of Framingham

- Jonathan Hecht of Watertown

- Denise Provost of Somerville

- Lindsay Sabadosa of Northampton

- Jay Livingstone of Boston

- Carmine Gentile of Sudbury

- Patrick Kearney of Scituate

- Chris Hendricks of New Bedford

- Christine Barber of Somerville

- Sean Garballey of Arlington

- Peter Capano of Lynn

- Michelle DuBois of Brockton

- Jim Hawkins of Attleboro

- Additional Co-sponsors are:

- Jack Lewis of Framingham

- David LeBoeuf of Worcester

- Jose Tosado of Springfield

- Ruth Balser of Newton

- Natalie Higgins of Leominster

- David Rogers of Cambridge

- David Robertson of Tewksbury

- Dylan Fernandes of Falmouth

- Mary Keefe of Worcester

- Bruce Ayers of Quincy

- Stephan Hay of Fitchburg

- Tram Nguyen of Andover

- Steven Ultrino of Malden

- Kay Khan of Newton

- Tommy Vitolo of Brookline

- Aaron Vega of Holyoke

- Liz Miranda of Boston

- Mindy Domb of Amherst

- Marcos Devers of Lawrence