Happy Saturday!

It’s so rewarding to see the fruits of our action continue to pay off!

For years, Act on Mass has organized around the idea that transparency reforms and strengthened constituent-rep relationships would give us a more effective, accountable, and democratic legislature—with better outcomes for the people of Massachusetts.

Last year, we got a huge win with the passage of new transparency reforms, including public committee votes. And in November, we saw how it could impact outcomes, when leadership attempted to fastrack an energy bill backed by the fossil fuel industry that would have gutted our state’s climate goals. Thanks to public committee votes, advocates and constituents were able to pressure individual representatives on the Energy Committee to block the bill. The public backlash generated was enough to make leadership pause the bill.

Unfortunately, the pause also left Bay Staters without cost relief for high energy bills as winter began. The legislature still needs to take action on energy affordability.

Currently, Beacon Hill’s preferred playbook is to get a few members of leadership together in a back room (perhaps with a few select fossil fuel lobbyists they, uh, fraternize with) and draft legislation they can push through before anyone blinks, knowing that rank-and-file members will be coerced to vote along. But our transparency efforts made that impossible. And they’re still playing defense.

This week, it was announced that House Ways & Means Chair Aaron Michlewitz would host four closed-door meetings next week for all House members to discuss energy affordability legislation. Such an extensive effort to court rank-and-file members and inform them about legislation is very rare in our legislature. Just as we hoped, our transparency efforts are forcing legislative leaders to treat rank-and-file legislators as, well, legislators—not just yes-men for their priorities.

It also means that your legislator will get the chance to weigh energy affordability legislation next week. Let them know that you’re looking forward to hearing the results of their meeting and share your priorities. Your feedback and supportare crucial if they’re going to stand up to legislative leaders on this issue. Make sure they hear from you!

TELL YOUR LEGISLATOR: CUT COSTS, NOT CLIMATE>>

Today, both Syd's Sprinkles and the "State House Scoop" have to do with municipal budgeting: the nitty-gritty of revenue raising in our state and how our legislature can help municipalities with it. We're starting with Syd's Sprinkles today because, well....... you'll see!

---

Syd's Sprinkles: So long, Saturday Scoop.

After working with Act on Mass as a Political Organizing Intern and now a Policy Fellow for over a year, I am sad to say that this will be my last “Syd’s Sprinkles” installment.

Over the past year, I have had the opportunity to learn from and work with so many amazing advocates for transparency here in Massachusetts. In working with Brenna, Erin, Scotia, and Lily, I have gained skills and knowledge that I intend to continue using as I complete my undergraduate education and venture into professional endeavors.

The good news is that I have one more contribution to the work that we do here at Act on Mass before I go. Below is an excerpt from and a link to my last blog post, which is entitled, “High Costs of State-Level Inaction: How Proposition 2 ½ Is Impacting Municipalities.”

Thank you for taking the time to read “Syd’s Sprinkles” and I hope that you learn something new from the blog post!

--

“High Costs of State-Level Inaction: How Proposition 2 ½ Is Impacting Municipalities.”

Inaction in the State Legislature here in Massachusetts does not only prevent things from getting done at the state level. Municipalities across the state have had to navigate keeping communities afloat as Beacon Hill has become increasingly inactive over the years.

For years now, the Legislature has been causing local standstills through inaction. As unrestricted state aid to local governments has declined, municipalities have been increasingly unable to collect sufficient property tax revenue to compensate.

Much of this inability can be attributed to Proposition 2 ½, which is a provision in state law that limits the amount of annual property tax revenue that can be collected by municipalities.

What is Proposition 2 ½? Read on for more!

---

State House Scoop

This week, the Senate kicked off its first major debates of the year, discussing a series of tax relief legislation targeted at surging property taxes. It’s the latest entry in a yearslong saga that dates back to the pandemic and contains many classic elements of Beacon Hill dysfunction.

How did we get here? A look at Massachusetts’ tax law for municipalities

Let’s do some background. In Massachusetts, somewhat unlike other states, state law places strict limits on the revenue-raising capacity of local governments. Towns and cities in Massachusetts are generally not allowed to levy local income or sales taxes. Yet, direct funding from the state budget to local governments in the Bay State is also small compared to other states(and declining!) This leaves Massachusetts’ municipalities highly reliant on property tax to fund local budgets.

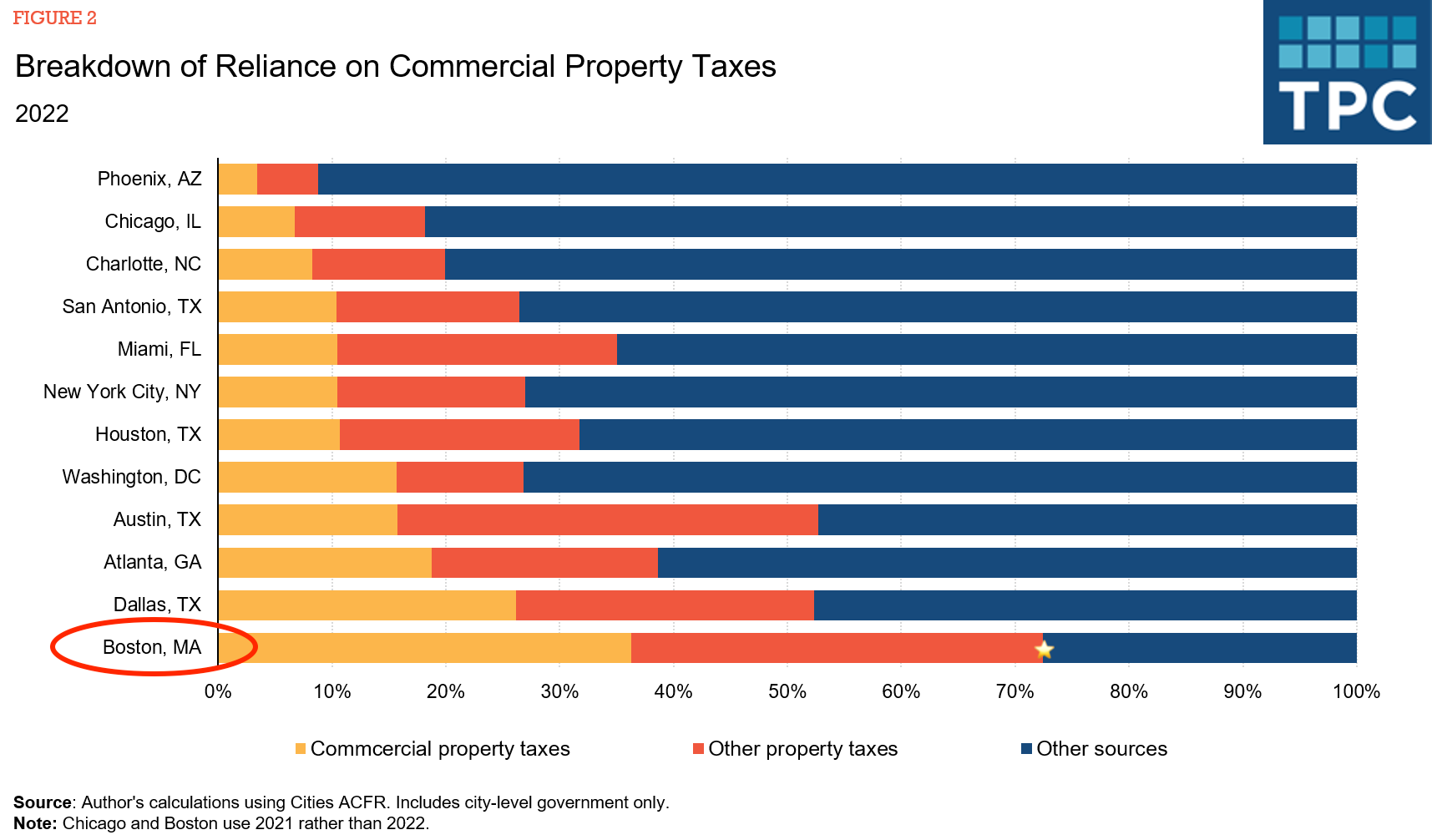

For example, consider this analysis of revenue sources for 12 major American cities. Boston, MA is an outlier in that over 70% of its revenue is drawn from property taxes, both commercial and residential.

This reliance on property tax leaves Boston (and other MA cities) “especially vulnerable” to fluctuations in the real estate market. And, if you haven’t quite blocked 2020 out of your memory, we just had a big one!

During the pandemic, as remote work surged and downtown offices sat empty, cities worldwide experienced a decline in commercial property valuation. In plain terms, there was less demand for commercial real estate, so prices went down. This has led to some eyebrow-raising transactions, like an office building in Boston’s Seaport district which sold this year for less than half of its sale price in 2015 (from $119 million → $52 million).

Local experts have projected that this decline in commercial real estate valuation could lead to a $1.7 billion budget shortfall for Boston in the next 5 years. Due to the limited revenue-raising tools available to Massachusetts’ municipalities, this revenue is likely to be made up by a reshuffling of property taxes. But how?

That’s the question at the heart of a $1.7 billion debacle that has eaten up years on Beacon Hill and cost Boston taxpayers a pretty penny.

From 2024 to today, Boston tax skirmish highlights Beacon Hill's refusal to address municipal concerns

In April 2024, Boston sent a “home rule petition” to the legislature, asking for permission to temporarily raise tax rates on commercial properties, to avoid automatic spikes in residential tax bills for homeowners. (Remember: since commercial property values had declined, a small tax “raise” for commercial properties still meant smaller monthly bills than they were paying the year before.)

The Legislature had passed so-called “tax shifts” before. In fact, just in 2023, it passed a similar home rule petition for the city of Watertown, allowing Watertown to shift more of its tax burden to commercial properties to provide relief for homeowners.

But, Boston is Boston, baby: corporate interests are more organized and have more to lose. The House approved Mayor Wu’s initial proposal, but Senate leaders demurred, waiting for “the business community’s sign-off.” In October 2024, business leaders reached a compromise with the city, agreeing to a small, temporary tax shift for commercial properties. The measure was approved 12-1 by the City Council, which represents the people of Boston. It was then passed by the House, raising hopes for tax relief.

Enter stage left: Senator Nick Collins, who represents part of Boston. Sen. Collins had kept quiet about the tax bill all year, but was fresh off a re-election and—notably—flush with $34,000 in new campaign donations from the real estate industry. All of the sudden, he emerged as a major opponent of the tax shift.

Because the discussion over the bill happened during “informal sessions” at the end of the 2023-2024 legislative session, Collins could block debate in the Senate with just his vote. Despite extensive lobbying by Boston seniors, Collin’s blockage served as a perfect excuse for Senate leadership to cite “insufficient support.” The session ended with no tax shift, and Boston homeowners saw increases of as much as 66% on their tax bills for last year.

Cut to this legislative session. Commercial property rates are still going down and Boston taxpayers are still on the hook. Tax rates are expected to rise an additional 13% in 2026. Mayor Wu and the City Council submitted another tax shift home rule petition to the Legislature in March of 2025. In a petty move, the Senate refused to even assign the bill to a committee. It sat without action through all of last year.

Yet, when the Wu administration started to turn up the heat in December, the Senate claimed that she was late to the negotiating table!

Instead of working with Senator Wu’s proposal, which is supported by the House, the Senate fast-tracked four proposals this week (one introduced by Collins) that would address large property tax increases with means-tested exemptions and rebates—all things that would cut into a city’s budget. I won't delve into the pros-cons of these proposals, but one thing is clear: this was not the approach chosen by the people of Boston and their representatives on the City Council. By refusing to consider Boston’s home rule petition and moving these proposals outside the traditional legislative process, Senate leadership denied the people their voice.

During debates on the measures on Thursday, Senator Michael Rush introduced an amendmentwith the same language as the tax shift proposal from Boston. His speech closed with a simple phrase: “I respectfully ask all of you for your consideration for the amendment as requested by the city of Boston and their representatives.” Unfortunately, the amendment failed 5-33, with all Boston senators except Sen. Collins and Sen. Brownsberger voting in favor. 31 Senators who do not represent Boston voted against the measure.

Here's another weird piece: House leadership, which has closer alliances with Boston, does not seem likely to take up these measures. Oddly, Senate leadership seems to be going scorched-earth on their relationship with the City of Boston to pass policies that might not ever become law. Rather than using this case to address the ongoing problem of municipalities' limited revenue options, it has become another casualty in the conflict between House and Senate.

Indeed, this is not just about Boston. Many of Massachusetts’ municipalities are still grappling with the economic upheaval of the pandemic, struggling to balance budgets with revenue-raising measures limited, high reliance on the real-estate market, and state aid declining. These problems need serious attention and long-term solutions, not stonewalling and political posturing. For more ideas on this, make sure you read Sydney’s blog post!

Finally, at the very least, it’s a cautionary tale for an election year. When corporate profits are at stake, you can be sure that your representative is hearing from our states’ moneyed interests. They need reminders that they work for us.

If there’s an issue that matters to you, make sure to get your representative’s stance on it before the election—and make sure they know you’ll be following up (watch State House 201 for tips and tricks!). And if you disagree with them, find someone to run against them. After the tax shift debacle this year, a few plucky Bostonians have made exactly that choice.

---

Immigration spotlight

As the toll of the Trump administrations' immigration enforcement actions continue to be felt in Massachusetts and nationwide, we wanted to continue highlighting local stories of how this is impacting Bay Staters and share calls to action.

- Boston quietly prepares for an ICE surge by Mike Deehan for Axios

- Immigrant families are shying away from medical care. A new court decision could worsen fears (paywall) by Sarah Rahal and Jason Laughlin, The Boston Globe

- Data offers glimpse into ICE agents’ presence in Boston district courts by Sarah Betancourt for GBH

- Federal authorities say deporting Babson College freshman was a ‘tragic case of bureaucracy gone wrong’ by Sean Cotter for Boston Globe

- Gov. Healey slams ICE tactics as ‘cruel and callous' by Sam Drysdale for State House News Service (in NBC 10 Boston)

Tell your legislator: we need state action to protect us from ICE! For more ideas, read last week's Scoop: "ICE is a danger to our communities. What can our state leaders do about it?"

TELL YOUR LEGISLATOR: ICE OUT OF MASS>>

---

What (else) we're reading this week

Some other stories from local and regional news:

- *Act on Mass featured!* Are Beacon Hill’s safe seats still safe? These insurgents say ‘No.’ They’re betting voters agree by John Micek for MassLive

- No way in and no way out: Beacon Hill hasn’t kept track of which communities qualify for Gateway City status by Hallie Claflin for Commonwealth Beacon

- ‘The math doesn’t work’: State report sounds alarm on future of Massachusetts farms by Emilee Klein for Daily Hampshire Gazette

---

Missed a Scoop or two? You can find a full archive of all past Saturday Scoops on our blog.

---

Take Action

"We keep us safe": save LUCE hotline to report ICE sightings in your neighborhood

Help keep your own neighborhood safe by keeping an eye out for ICE vehicles and reporting sightings to the LUCE hotline. LUCE can also connect you to groups doing ICE watch in your area for training. Check out their website today!

WE PROTECT US: EXPLORE LUCE RESOURCES>>

Tell your legislators: take action to protect Massachusetts' tax code from Trump cuts!

The Big Beautiful Bill passed by Congress this year makes devastating cuts to SNAP and Medicaid benefits to pay for massive tax cuts to Trump's billionaire friends. If Massachusetts doesn't act to "decouple" our state tax code from these federal changes, they will cost the state as much as $1 billion in annual tax revenue. Legislators need to act now to protect state programs. Tell them today!

TELL YOUR STATE REPS: NO BBB FOR MA>>

---

That's the Scoop. Thanks for reading! In signing off, I want to give another thank you to Sydney Mascoll, for more than a year of incredible service to our mission of transparency and accountability. We are sad to lose her, but very excited for what's to come. Thanks to all!

In solidarity,

Scotia

Scotia Hille (she/her)

Executive Director, Act on Mass