If you felt things were a little strange on Thursday, perhaps it was because of the full moon.

And by “full moon” I mean the thong-clad Extinction Rebellion protesters who interrupted the Senate tax cut bill debate this week.

Photo courtesy of Senator Jamie Eldridge’s Twitter

Via butt writing, the protesters demanded our legislators “stop passing gas.” In addition to being objectively hysterical, they’re absolutely right: as we discussed in last week’s Scoop, Massachusetts is on pace to achieve 100% renewable energy by 2090. And even worse, our lawmakers aren’t even making choices that align with our inadequate goal; from the Peabody Peaker Plant to a liquified natural gas plant in Charlton, there are numerous fossil fuel infrastructure projects being constructed in the state right now—projects that have every intention of burning fossil fuels for generations to come. Read Extinction Rebellion’s full statement here.

All right, enough cheekiness, let’s dive in.

State House Scoop

Senate passes tax cut bill, differs immensely from House’s version

The Senate passed their version of the big tax cut bill on Thursday, leaving it largely identical to the version proposed by Ways & Means we covered in last week’s Scoop. To save you a click: the Senate’s bill is much, much better than the House’s version, particularly because they opted to skip two of the House's three regressive tax cuts. Unfortunately, the Senate still included the cut on the estate tax, doubling the threshold from $1 million to $2 million.

The differences between the two versions reflect the ongoing debate about how to make Massachusetts “competitive,” and, more importantly, for whom. The House (and Healey) believe that rich people and corporations are fleeing Massachusetts because the taxes are too high—and by leaving, making everyone worse off. Um, Ronald Reagan called, and he wants his tax policy back.

We know that the theory of trickle-down economics is a total myth. And, thanks to reporting and analysis from MassBudget, we know the idea that droves of people are fleeing Massachusetts because of taxes is also a total myth.

Fortunately, Senate President Spilka appears to be less persuaded by this myth of “competitiveness”; she justified her more moderate tax proposal by saying “we need to focus on individuals and working families, at least right now.” If only some scrappy legislative watchdog had been saying that for weeks!

Then again, talk is cheap—unlike housing in Massachusetts. The key feature of the Senate tax bill that purports to reduce cost of living is funding for the Housing Development Incentive Program, or “HDIP.” But in reality, only 2% of HDIP-funded housing has been affordable. Consequently, it tends to act more as a catalyst for gentrification and displacement than lowering housing costs for people who need it most.

Senator Jamie Eldridge filed an amendment to the tax cut bill that would require that at least 20% of HDIP housing be affordable units. This amendment died 30-9. See how your Senator voted (and more fantastic analysis of the debate from our friends at Progressive Mass) here. Why would 30 senators vote against a mere 20% affordable housing requirement, especially when we know that, as-is, HDIP makes the housing crisis worse, not better? Well, there are a lot of ways to answer that question. Here’s one: President Spilka didn’t support it, and senators are loath to break from the pack.

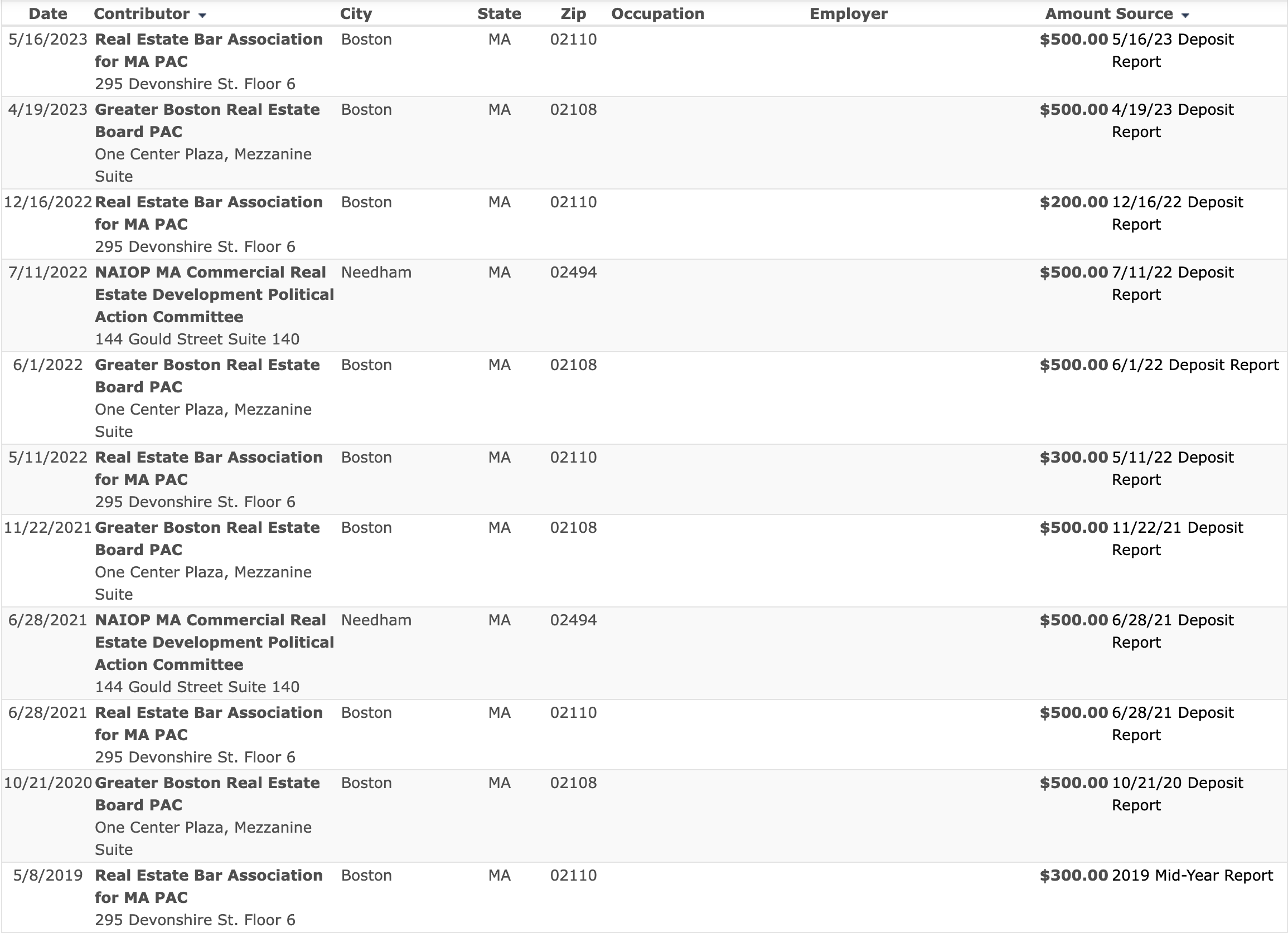

Here’s another: the real estate developer lobby has invested quite a bit in the Legislature, and you don’t invest unless you expect a decent return…

--

Missed a Scoop or two? You can find a full archive of all past Saturday Scoops on our blog.

--

Next steps: Conference Committee

Now, the many differences between the House and Senate versions of the tax bill will be negotiated by a conference committee behind closed doors, with no deadline. And the business lobby has made no secret that they plan to privately lobby the legislators appointed to the conference committee. And we’re not just going to cede the floor to them are we? Email your legislators and tell them to urge the conference committee to not include tax cuts for the rich and corporations in the final version.

FIND YOUR LEGISLATOR’S CONTACT INFO >>

Happy pride! Now give us gay sex ed: A special Scoop item by Brenna

Ah, sexual education — nobody’s favorite topic to talk about, or at least that’s what the co-chair of the Progressive Caucus told me a few weeks back at the Healthy Youth Act Lobby Day when I asked them why this bill has seen such little progress. Despite massive cosponsorship support and the Senate passing the HYA four times, the House has refused to touch the bill with a ten-foot pole. But is the discomfort of legislators an acceptable excuse for over a decade of inaction?

The HYA is a prime example of how democratic dysfunction on Beacon Hill has put undue harm on some of our most vulnerable populations, particularly LGTBQ+ youth. First introduced in 2012 — yes, that’s eleven years ago — HYA would ensure that sex ed curriculum in our public schools is 1) medically accurate; 2) consent-based; and 3) LGBTQ+ affirming. You know, the bare minimum.

Act on Mass recently joined the Healthy Youth Act Coalition to join in the fight to pass HYA this session because our youth — particularly queer youth — deserve to be visible, uplifted, and empowered to have a safe and healthy relationship with sex. We’ll be hosting a Letter to the Editor workshop for the Healthy Youth Act next month, so stay tuned for more info and ways to get involved!

The fight for reparations in Massachusetts

Structural anti-Black racism resulting from centuries of slavery is alive and well in the U.S., and despite our progressive reputation, Massachusetts is far from an exception. WBUR noted just this past week that the average infant mortality rate among Black Bostonians was three times higher than their white counterparts, and Black maternal outcomes are actually getting worse. The next day, Blue Cross Blue Shield released a report on racial health disparities in the Bay State, concluding: “Populations of color in the state are disproportionately affected by housing instability, food insecurity, environmental toxins and stressors, and higher rates of poverty as a result of longstanding systemic racism...”

With Juneteenth on Monday, let’s take a moment to highlight the fight for reparations here in the Bay State. Amherst is poised to be the second town in the country to offer reparations to its Black residents, and could begin disbursing funds as early as 2024. On Beacon Hill, Senator Liz Miranda has filed bills which would create a statewide reparations commission, and establish a reparations fund, respectively, although neither has picked up much steam. We (and all other progressives across the state and country) will be cheering on Amherst as they lead this fight in Massachusetts, and, God willing, set a model for the rest of us to follow.

--

Enjoying the Scoop? Help us keep writing it!

Our big fundraising deadline for the fiscal year is June 30th. To everyone who has given to this fundraiser thus far: thank you for making the work we do--like the Saturday Scoop--possible. Unfortunately, we're still about $2,000 behind our goal. If you enjoy the Scoop and want to support it, consider making a gift today! A donation of any size goes a long way to keeping us in the fight for transparency and accountability on Beacon Hill:

DONATE TO OUR END-OF-FISCAL YEAR FUNDRAISER >>

--

That's all for now! Enjoy your rainy weekend.\

Stay cheeky,

Erin Leahy

Executive Director, Act on Mass

--