The Massachusetts State House has a certain M.O.: at the start of the session, reps file upwards of 7,000 bills. But the vast majority of these receive little to no discussion and are sent to study come February.

A trickle of bills are passed throughout the session, but the firehose of legislation turns on in June and July–just before the deadline. Most of the bills that come to a vote this late weren’t filed at the beginning of the session and never received a committee hearing; they’re bills that have been cobbled together and written by House and Senate leadership behind closed doors.

These omnibus bills are brought to the floor for a vote with 24 hours notice or less. Amendments to change or improve the legislation end up buried in “consolidated amendments” – a process that also takes place, you guessed it, behind closed doors.

The result is a unanimous or near unanimous vote on a giant piece of legislation, crafted out of view of the public, and with little to no debate on the floor.

This M.O. was on full display this past week on Beacon Hill.

State House Scoop

House passes $4.2 billion spending bill

After two formal sessions and nearly 900 amendments, the House passed a major spending bill on Thursday. And as with any multi-billion dollar bill, there’s a lot to discuss. So let’s break this into bite-sized scoops:

The good

This budget-adjacent bill includes many budget-adjacent things, like earmarks for local projects, and funding for housing and health care programs. But most importantly, this bill is a tax cut–$524 million in tax cuts, to be exact. Many cuts proposed in the bill would provide relief to low and middle-income families and individuals. That’s great! If only the cuts stopped there.

The bad

Unfortunately, this bill also included a major tax cut for the wealthy: it would raise the threshold for the estate tax from $1 million to $2 million. This tax cut, championed by Governor Baker, would cost the state over $200 million per year and affect just 2,500 of the wealthiest taxpayers in the state annually. I’m no math wiz, but by my count almost half of the tax cut package is being spent on the estate tax cut. Essentially a tax on inherited wealth, the estate tax is the only tax that addresses the racial wealth gap. And our Democratic supermajority just slashed it in half.

The ugly

In addition to tax cuts, our legislators proposed a tax rebate–a one-time check of $250 to return some taxpayer money directly back whence it came. Here’s the thing: in order to be eligible for a rebate, the bill specified that your annual income had to be between $38,000 and $100,000. That’s right: low-income people, the people who need it the most, are excluded from these rebates.

Voice votes used to reject popular progressive amendments

Despite the time crunch, some progressive reps banded together and filed amendments to the spending bill that would have addressed these issues; Rep. Erika Uyterhoeven filed #630, which would have reigned in the estate tax cut, and Rep. Tami Gouveia filed #813, which would have made people making less than $38,000/year eligible for rebates.

Leadership tried to bury these amendments before they could even be heard on the floor by “consolidating” them into a giant mega-amendment. Thankfully, the sponsors of both of these amendments objected to their amendments being tossed out without debate, and were at least able to speak on the floor.

Want to see how your rep voted on these issues? Well, you’re out of luck. Unfortunately, neither rep requested a roll call vote, so both critical and popular amendments were killed on a mere voice vote. There is no record of rep’s stances on these amendments. This is particularly disappointing during an election year–surely now, more than ever, voters deserve to know where their rep stands on issues like these.

--

In other news

Senate passes abortion access bill, one key difference with House version

Following the House’s lead, the Senate passed a major reproductive rights bill this week. Both versions protect MA providers from out of state lawsuits for providing abortion and gender affirming health care. The one key difference is about when to permit abortions after 24 weeks of pregnancy; the House bill would allow these rare later-term abortions in the case of severe fetal anomalies, whereas the Senate would only permit them in the case of fatal fetal anomalies. If that doesn’t sound like a big distinction, consider the story of Kate Dineen, a Massachusetts woman who had to travel to Maryland to receive an abortion after learning that her son had a catastrophic stroke in utero at 33 weeks pregnant.

--

Take Action

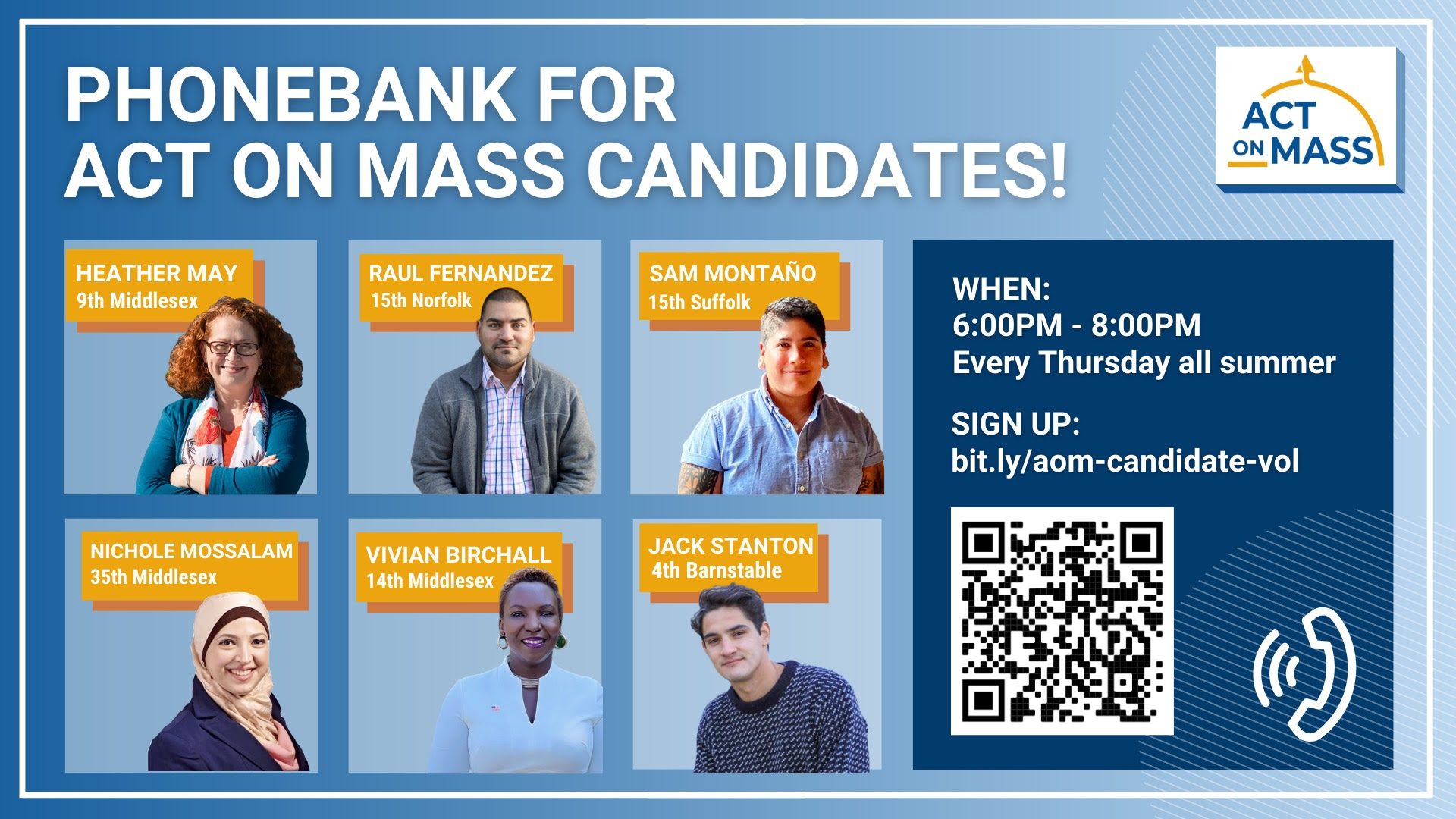

Thursdays at 6:00PM: Phonebank for our Endorsed Candidates!

You read it right! Every Thursday this summer we’ll be making calls for our incredible roster of endorsed state rep candidates. Phonebanking is fun, easy, and absolutely vital for our candidates to win. Plus, you’ll get to hang out with the coolest people on Earth for two hours a week: Act on Mass volunteers! Join us:

--

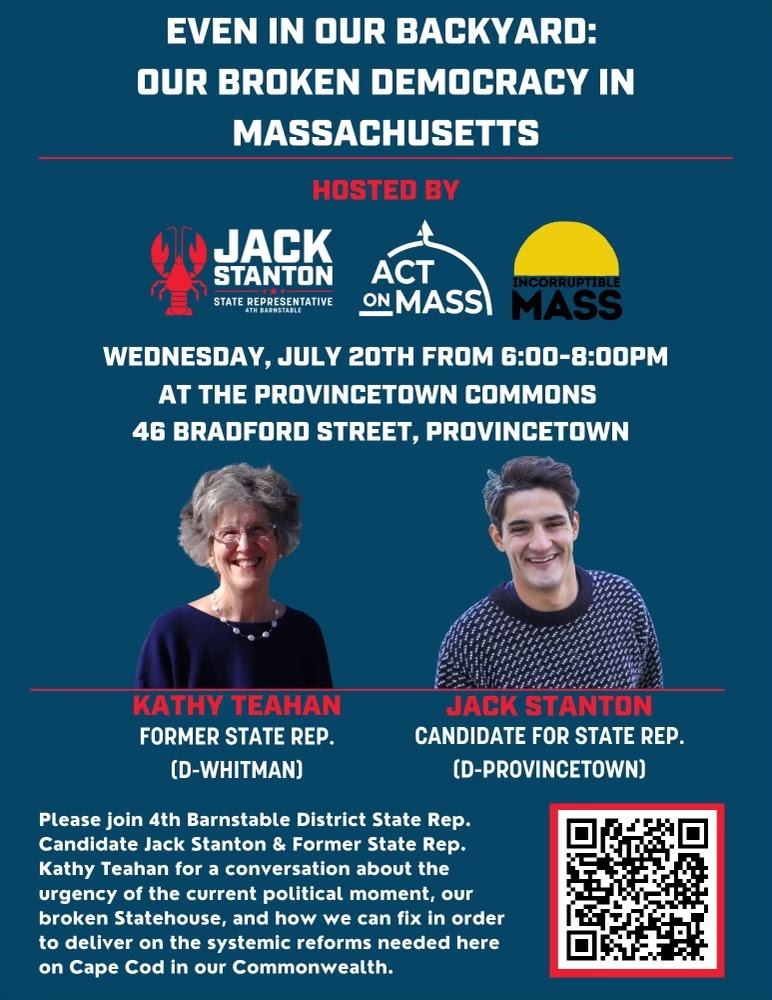

Even in our Backyard: Our Broken Democracy in Massachusetts - 7/20 6:00PM

Join us for a special hybrid event with one of our endorsed candidates, Jack Stanton, and Former State Rep Kathy Teahan (D-Whitman) sponsored by Act on Mass and Incorruptible Mass. Register to attend virtually or in person!

--

This week served as a great reminder of the stakes of State House reform; if our legislature were truly accountable to everyday people, we would have gotten tax rebates for low-income folks. We would have preserved the estate tax instead of widening the racial wealth gap. And who knows what else we could have accomplished?

That’s all the Scoop I have in me this week. A bit of housekeeping: I won’t be in your inbox next Saturday as I’ll be on a family vacation in Maine. Perhaps we'll have our first ever Tuesday Scoop!

--

Until then,

Erin Leahy Executive Director, Act on Mass