It’s been more than a month since a Red Line train derailed, injuring several people and throwing our transit system into chaos. We still don’t know the cause. The cost of repairing and modernizing the MBTA has been estimated at $10 billion.

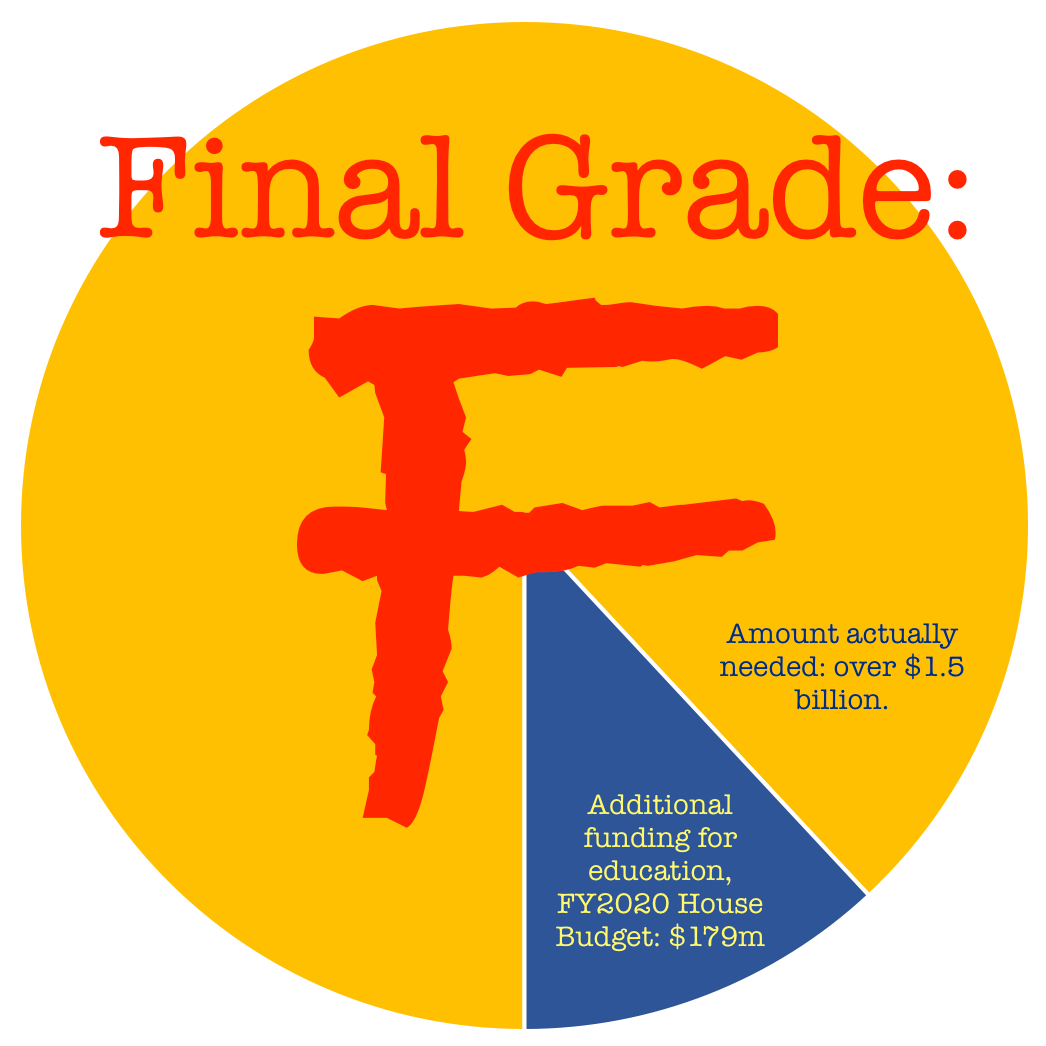

Public education isn’t doing much better: Massachusetts’ public schools have some of the worst racial inequalities in the nation. They are underfunded by more than $1 billion per year, including a large funding gap for low-income students.

College students are suffering too: student debt in Massachusetts is growing at the second-fastest rate in the country for public colleges alone, largely due to a funding gap of over $500 million per year.

That’s $10 billion for transportation, plus $1.5 billion every year for education. Now the legislature is on track to pass another woefully inadequate budget that will fail to address the problem. (Actually, they’re not on track: credit rating agency Moody’s cited “governance weakness” as a risk in Massachusetts because our budget is over 2 weeks late.) The additional funding proposed for education is only about 1/8 of what is actually needed:

While trains are literally falling off the tracks and students are dropping out of school because they’ve run out of money, lawmakers talk about this lack of revenue as if it is something that they can’t control. The question, “How are we going to pay for it?” is constantly repeated by legislators, who are often more interested in holding up legislation than actually finding money to pay for things.

So why can’t we have nice things? It’s easy to blame our Republican Governor, Charlie Baker (who isn’t helping). But our legislature, which has a Democratic supermajority that could easily override a veto, actually has a track record of conservative tax policy. From 1977 to 2016, Massachusetts cut taxes more than 47 other states, with those cuts disproportionately going to the wealthy. This includes a decrease in the capital gains tax, which tends to apply to the state’s highest earners on transactions such as selling stock or flipping houses, from 6% to 5.05%. Since the late 1990s, we’ve passed a series of tax cuts that costs us over $4 billion per year.

[

Source: MassBudget

Even after the Trump tax cuts, which resulted in an average tax cut of over $84,000 for the state’s top earners, there hasn’t been much urgency to act. Just last year, Speaker DeLeo again pledged not to raise taxes in a speech to the chamber. More recently, he has made vague promises to have a “conversation” on raising new revenue later. But that didn’t seem to be a high priority now: In this year’s budget, Democratic lawmakers, led by budget chief Aaron Michlewitz, rejected tax increases on e-cigarette sales and opioids proposed by Governor Baker and incorporated no new ideas of their own.

Back when we had a Democratic Governor, Deval Patrick, House leadership still took a more conservative approach on revenue. In 2014, Speaker DeLeo introduced a budget that funded important programs and services at much lower levels than Patrick proposed, citing a desire to not raise taxes. This was after the 2013 repeal of a “tech tax” just months after it took effect, for which the legislature had no backup plan, and after Beacon Hill leadership insisted in 2013 that tax increases for transportation should also be accompanied by cost-cutting.

Over and over, legislators use lack of revenue as an excuse to not pass progressive policy, and don’t take action to raise that revenue. This spring, when Rep. Mike Connolly proposed raising the capital gains tax, most members of House leadership did not even co-sponsor the amendment, let alone advocate for it. This includes Alice Peisch of Wellesley, the House Chair of the Joint Committee on Education who has argued against fully funding public schools and in favor of charter school expansion; Majority Leader Ron Mariano, who has complained that “the MBTA doesn’t have any money” and called it a disgrace; and Representative Mark Cusack, the House Chair of the Joint Committee on Revenue who recently proposed a rule change that would make the legislature even less transparent than it is now.

Over and over, legislators use lack of revenue as an excuse to not pass progressive policy, and don’t take action to raise that revenue.

There won’t be a chance to include meaningful progressive revenue in this year’s budget, which is already 2 weeks late. The Fair Share Amendment, a constitutional amendment that would levy a 4% additional tax on incomes over $1 million, will take effect no earlier than 2023. That’s 4 years away, and 4 classes of students will graduate from woefully underfunded public schools in that time. It’s also not enough money: the amendment is predicted to generate between $1-2 billion in additional revenue per year, which is badly needed but would barely cover the funding gap for education alone.

Every year, legislators have the opportunity to file and demand votes on amendments to raise necessary revenue or to pass progressive policies. They can file amendments to the budget as well as to individual pieces of legislation. But they usually withdraw them before they can be brought to the floor, which means that not only does the proposal fail, but we don’t even have a record of how our Reps vote on it. This happened just a few months ago; did you hear about any amendments to raise taxes or close tax loopholes? They were all withdrawn, and we don’t know who really supported them.

In a legislature where public votes are few and far between, it’s not enough to believe the right things and hope for a chance to eventually vote on them. Voters need to know where their reps stand on important policies that mysteriously fail to pass year after year, or else they don’t know who to call to change that.

In a legislature where public votes are few and far between, it’s not enough to believe the right things and hope for a chance to eventually vote on them. Voters need to know where their reps stand on important policies that mysteriously fail to pass year after year.

Speaker DeLeo, who is 69 and is rumored to be planning his retirement soon, has promised a “conversation” on revenue this fall. It’s not clear what exactly that will include, but it’s clear that small fixes and passive legislating won’t be enough. Reps will need to demand a debate on serious change to our tax policies.

For the past several years, legislators have blamed Beacon Hill’s lack of progress on a conservative Speaker who has accumulated a great deal of power over his long tenure. But Speaker of the House is an elected position, and Reps re-elect Robert DeLeo every session. Eventually he will pass the torch to a new Speaker, who our representatives will also elect. Will they elect another conservative Speaker who blocks progress? When is enough enough?